芝加哥商品交易所研报:欧洲外汇和债券市场表面上风平浪静,背后呢?

来源:市川新田三丁目 市川新田三丁目

译者 王为

文中黑字部分为原文,蓝字部分为译文,红字部分为译者注释或补充说明

Europe‘s Calm FX, Bond Markets Masking Anxiety?

By Erik Norland

The Eurozone economy stalled in the fourth quarter of 2019 after seven years of recovery, dragged by a contraction in France and Italy, stagnation in Germany and the European Central Bank (ECB) holding firm to negative interest rates at -0.4% even as core inflation hovered just below 1% at the end of last year.

受累于法国和意大利经济负增长、德国经济增长乏力以及欧洲央行无视欧元区的核心通胀率在2019年底时处于略低于1%水平的事实执意将政策性利率的水平维持在-0.4%等因素,欧元区经济在连续七年扩张后于2019年四季度开始陷入停滞。

And that was before COVID-19. The region’s economy is now widely expected to shrink by 4% to 8% in 2020 and budgets that were close to being balanced overall in 2019 are widely expected to show deficits of 20% or more of GDP this year as spending surges and tax revenues dwindle. The ECB, meanwhile, has ventured deeper into negative-rate territory, cutting rates to -0.5%.

这一切都发生在新冠疫情到来之前。如今市场上普遍认为欧元区的经济总量将在2020年里缩水4%到8%,而2019年已近乎实现预算收支整体平衡的大好局面如今也被广泛认为将恶化到2020年欧元区各国的预算赤字将不低于GDP总量的20%,因在财政支出大增的同时税收收入却在减少。与此同时,已身陷负利率政策的欧洲央行继续将基础利率的水平降至-0.5%。

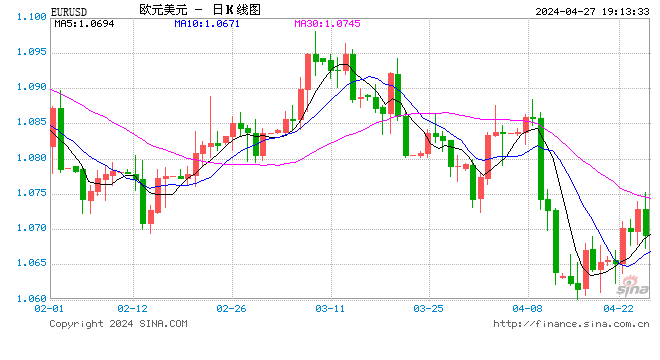

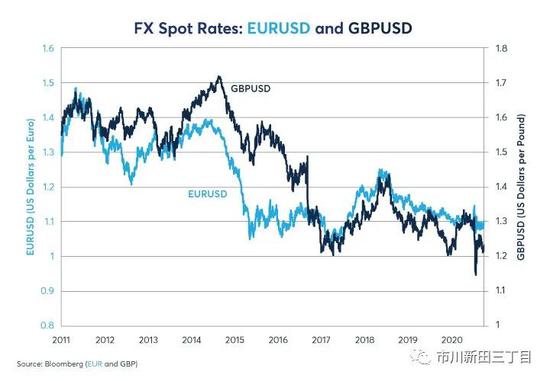

Despite these challenges, European markets have reacted with relative aplomb. European equity markets have risen although somewhat below the performance of their US counterparts, while the euro (EUR) and the European bond market have been remarkably stable (Figures 1 and 2). Italian and Spanish bond spreads have widened but so far nothing akin to the 2009-2012 period has happened.

尽管面临这些挑战,但欧洲金融市场的反应却坦然自若。升幅虽不及美国,但欧洲股市毕竟也在上涨,而欧元汇率以及欧洲债券市场的走势则相对比较平稳,见下图1和图2。意大利和西班牙国债的收益率与德国同期限国债的收益率之间的利差虽有所扩大,但扩大的幅度没有2009-2012年期间那么大。

Figure 1: With the US and Europe in a similar position, EURUSD has shown little reaction to COVID-19

图1:虽然欧美同样受到新冠疫情的影响,但欧元/美元的汇率走势却波澜不惊,图中浅蓝线为欧元/美元汇率,深蓝线为英镑/美元汇率

Figure 2: Compared to 2009-12, European bonds have been cool, calm and collected

图2:与2009-2012年相比,当下欧洲债券市场的反应称得上是既冷静又理性,下图中是欧元区各主要国家10年期国债收益率的走势

That Eurozone bonds have been stable is remarkable. Not only have bond holders had to contend with dramatically deteriorating fiscal conditions across the currency zone, but, on May 5, Germany’s Constitutional Court upheld several complaints against the ECB’s Public Sector Purchase Program (PSPP), which is the main vehicle used by ECB to prevent a widening of bond yield spreads between the debt of various Eurozone members. For its part, the ECB responded by saying that it was under the jurisdiction of the European Court of Justice and not national courts.

欧元区债券市场的安之若素不禁让人啧啧称奇。不仅因为债券投资者需要应对欧元区各国财政状况急剧恶化的局面,而且德国宪法法院在5月5日做出裁决力挺针对欧洲央行的“公共部门债券购买计划”的反对意见,而“公共部门债券购买计划”是欧洲央行颇为倚重的一项手段,目的是防止欧元区各成员国的国债收益率之间的利差进一步扩大。欧洲央行这边则回应称此案的司法管辖权应归欧洲法院而非各个成员国的法院。

At the very least, this controversy reminds investors of the Eurozone’s unique set up: it has a common currency but 19 different national fiscal policies. Lacking a common fiscal policy, Eurozone members are supposed to adhere to certain rules including:

但至少,这一争议让投资者再次注意到欧元区独特的构成机制:欧元区有共同的货币,但19个成员国的财政政策却相互独立。由于缺乏统一的财政政策,欧元区各成员国被认为应该遵守以下几项规则:

-

Fiscal deficits must not exceed 3% of GDP. In 2019, every Eurozone member met that criteria, but from 2008-2014 many, and in some years, most did not. Following the pandemic, it may take many years for member states to reign in deficit spending to within the 3% range.

-

一国的预算赤字占本国GDP的比率不超过3%。2019年各成员国均达标,但在2008-2014期间很多成员国没有达标,同时在某些年份里大多数成员国均没有达标,新冠疫情的爆发可能会导致各成员国需要很多年的时间才能重新将预算赤字控制在GDP的3%以内。

-

Gross government debt must not exceed 60% of GDP. As of Q3 2019, only two Eurozone countries, Finland (59% public debt/GDP) and the Netherlands (49%) met that criteria – although Germany and Ireland were close (61% and 63%, respectively). Meanwhile, Austria’s public sector debt was 71% of GDP; Belgium, France and Spain were close to 100%, Portugal was at 120%, Italy just below 140% and Greece nearly 180%.

-

一国的政府债务总量不能超过本国GDP的60%。2019年3季度,只有两个成员国该项指标合格,芬兰为59%,荷兰为49%,其他两个比较接近的国家为——德国61%,爱尔兰63%。此外,奥地利的公共债务占GDP的比率为71%,比利时、法国和西班牙的比率将近100%,葡萄牙为120%,意大利略低于140%,希腊则将近180%。

It’s largely the ECB bond-buying program, the result of former ECB President Mario Draghi’s promise in 2012 to do “whatever it takes” to keep the eurozone together, that has prevented a substantial expansion of intra-country spreads. Nevertheless, the European bond investors shrugged off the German court’s ruling. For the moment, the ECB appears likely to continue absorbing a large portion of the debt issuance of the Eurozone’s member states.

欧元区内各国国债收益率之间的利差之所以没有出现大幅飙升很大程度上应归功于欧洲央行的购债计划,即欧洲央行前任总裁德拉吉在2012年做出的将“竭尽所能”确保欧元区局势稳定的承诺的产物。不管怎样,欧元区的债券投资者们对于德国法院的裁决不屑一顾。至少从目前来看,欧洲央行似乎仍将继续吃进欧元区各成员国新发行的大部分国债。

Even so, at some level investors must be worried. In the US or UK, for example, there is one sovereign debt issuer and one central bank to manage the currency and the debt markets. In the Eurozone, there are 19 separate government debt issues and one supranational central bank. In this regard, the Eurozone doesn’t really have a sovereign debt market at all but rather a public debt market that looks more like the municipal debt market in the US. However, unlike US States and municipalities, which normally have to balance their budget, Eurozone nations usually run deficits and can accumulate enormous debt relative to the size of their economies. Indeed, this is why the ECB’s bond-buying program sometimes raises opposition from inflation and budget deficit hawks: they see ECB buying of individual country debt as being a backdoor path to debt mutualization and a common fiscal policy.

即便如此,投资者还是应该在一定程度上保持警惕。以美国或英国为例,这两个国家自己发行国债且有自己的央行来管理本国货币的汇率和债券市,但欧元区有19个国家在发行国债外加一个超国家的央行。在这方面,欧元区根本没有形成一个真正意义上的主权债务市场而是存在一个类似于美国市政债券市场的政府债务市场。但与美国的州政府和地方市政府通常自求收支平衡的做法不同的是,欧元区成员国通常总是处于财政赤字状态,其国债总量相对于其GDP总量来说明显过高。确实,这就是为什么欧洲央行的购债计划有时候会引来对通胀率上升以及预算赤字忧心忡忡的人士非议的原因:他们认为欧洲央行买入单一成员国的国债等于是给共同分担各国政府债务以及统一的财政政策开了一个后门。

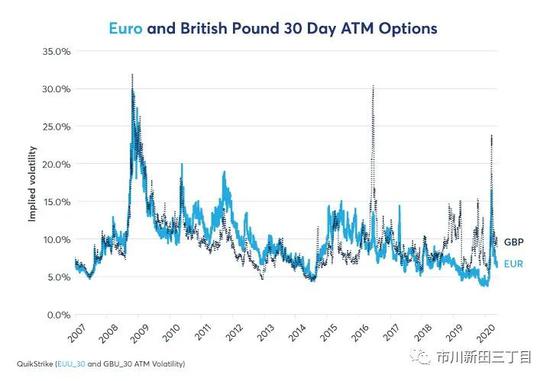

Despite the hit to the economy and political controversies in Europe, on the surface, EURUSD options markets, like the Eurozone government bond market, are also relatively calm. Implied volatility on EURUSD at-the-money (ATM) options spiked from 4% to 15% in March during an incipient dollar-funding crisis at the nadir of the equity market selloff. However, after the Federal Reserve stepped in, providing dollar liquidity and swap lines, currency option volatility returned to its 2012-2019 average levels. Moreover, at the peak of volatility in March, EURUSD 30-Day ATM implied volatility was only halfway to where it peaked in 2008 and 2009 (Figure 3).

尽管欧洲经济遭遇冲击外加政治争议不断,但从表面上看,欧元/美元期权市场与欧元区债券市场一样,也相对比较平静。在3月份因受股市大跌影响美元融资危机初现之时,欧元/美元30天期限平价期权的隐含波动率从4%猛升至15%。但在美联储出手相救,提供美元流动性以及美元互换安排后,外汇期权的波动率水平重返2012-2019年期间的均值。此外,欧元/美元30天期限平价期权的隐含波动率3月份的峰值水平仅有2008和2009年期间最高点的一半,见图3。

Figure 3: On the surface, the EURUSD options market looks relatively calm.

表3:表面上看,欧元/美元期权市场比较平静,图中浅蓝线为欧元/美元的30天期限平价期权隐含波动率,深蓝线为英镑/美元的30天期限平价期权隐含波动率

Below the relatively calm surface in the EURUSD options ATM price, currency option traders are clearly anxious. This nervousness becomes apparent when one takes a deeper dive into the EURUSD options market’s pricing, examining two other aspects of the options market:

在欧元/美元平价期权市场波澜不惊的现象背后,外汇期权交易员们却很明显处于焦虑之中。如果对欧元/美元期权的报价多加分析就会看清这种焦虑的情绪变得愈加鲜明,我们来看看与期权定价有关的其他两个指标:

-

Skewness: how implied volatility of out-of-the-money (OTM) put and call options varies across different strike prices.

期权报价的偏斜度:体现的是价外看涨期权和价外看跌期权在各个行权价水平上的隐含波动率的变化情况。

-

Volumes: how much of each option is trading across different strike prices.

同一类期权在各个行权价水平上的成交量变化。

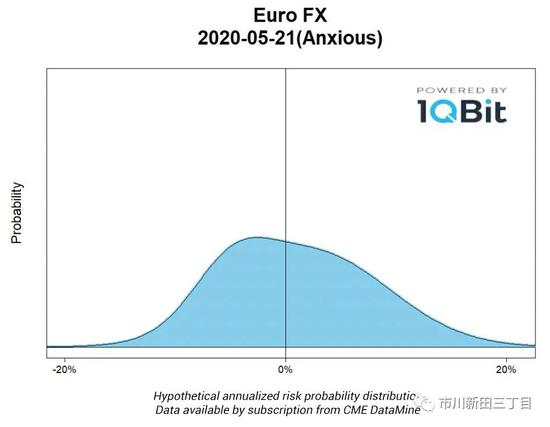

Rather than a traditional normal-distribution-like peak in the possible outcomes for EURUSD, we see a flat, broad top with a bump on the left-hand side. This reflects substantial buying of both put and call options away from the money with some traders especially nervous about extreme downside for EUR. This doesn’t mean that extreme downside (or upside) moves will materialize in real life, but investors apparently see the Eurozone as being under a great deal of stress and, to a greater-than-usual extent, they are buying a lot of downside put protection and some upside call protection as well (Figure 4).

欧元/美元汇率期权的回报分布并不像传统的正态分布形态那样会出现一个明显的峰值,其顶部区域比较平缓宽阔,并偏向左侧。这种回报率分布形态说明价外看涨期权和价外看跌期权的买入需求都很多,其中一些交易员尤为担心欧元汇率会出现极端的下跌。这并不意味着欧元汇率极端的涨跌一定会成为现实,但投资者很显然认为欧元区面临巨大的压力,因此比以往更加积极地买入看跌期权防止欧元汇率下跌,同时也在买入一些看涨期权防备欧元汇率上升,见下图4 。

Figure 4: Taking protection on the downside, and upside too.

图4:投资者买入期权既防备欧元汇率贬值,也防升值

Bottom Line

要点

-

On the surface, European markets appear calm

-

表面上看,欧洲金融市场还算平静

-

Under the surface, investors are buying protection against extreme EURUSD moves

-

背地里,投资者却在采取避险手段防止欧元/美元的汇率出现极端波动

-

With ECB bond buying, intra-European bond spreads have not widened much

-

在欧洲央行的购债举措保障下,欧元区内各国国债收益率之间的利差没有出现大涨

免责声明:自媒体综合提供的内容均源自自媒体,版权归原作者所有,转载请联系原作者并获许可。文章观点仅代表作者本人,不代表新浪立场。若内容涉及投资建议,仅供参考勿作为投资依据。投资有风险,入市需谨慎。

责任编辑:郭建